The COVID-19 pandemic brought drastic changes to many industries. One industry that saw some of the biggest effects is aviation. What has this meant for airlines and pilots? Read on to learn more about the impact of COVID-19 on the aviation industry over the last couple of years, and how we can address what’s expected next!

A decrease in demand for flights — that’s starting to pick back up

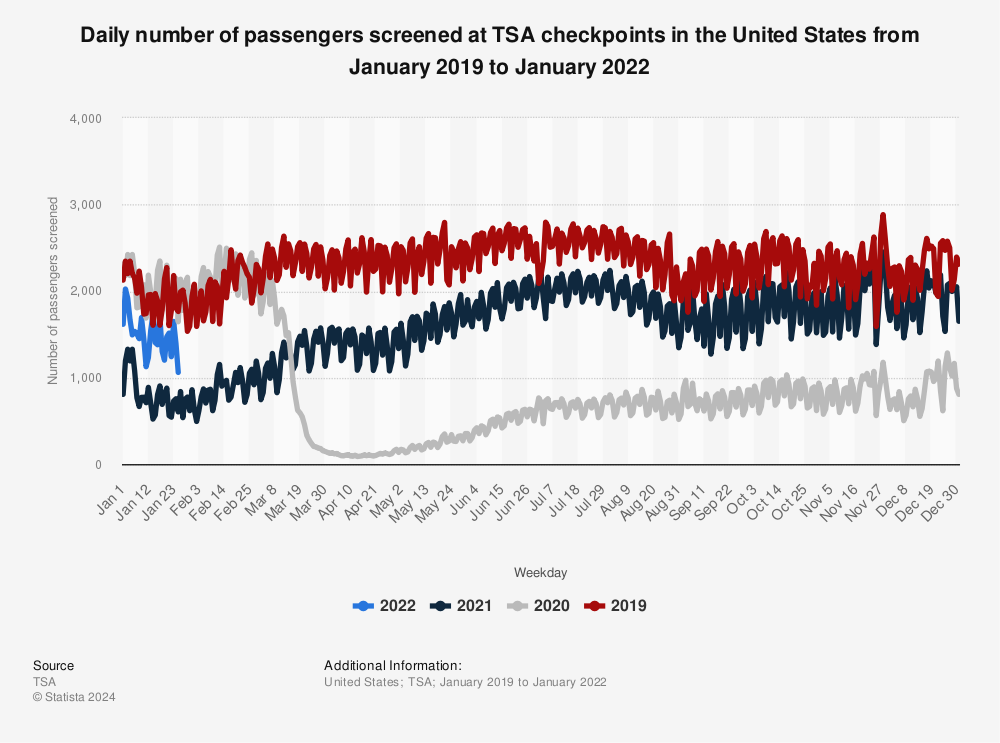

As a response to COVID-19, countries all over the world closed their borders, trips were canceled, and airlines reduced the capacities on their flights. According to Statista, a 2019 growth in global air traffic passenger demand of 4.1% was followed by a global decline of at least 2.8 billion passengers in 2020. However, things have already begun to increase, though still not to pre-COVID levels. On January 25, 2021, the Transportation Security Administration (TSA) screened nearly 468,933 passengers at US airports, and that number increased to 1.06 million passengers on the same weekday in 2022.

A need for more pilots

While 2020 saw the demand for pilots come to a halt, the threat of a pilot shortage had long been looming. In fact, a 2019 Oliver Wyman poll of flight operations leaders noted that 62% of respondents listed a shortage of qualified pilots as a key risk, with the root cause of the anticipated shortage in the US being “an aging workforce facing mandatory retirement, fewer pilots exiting the military, and barriers to entry, including the cost of training.” The shortage then turned into a surplus in 2020, as fewer flights led to a smaller need for pilots.

However, this surplus isn’t expected to last, and according to Oliver Wyman, it’s not a matter of if, but of when. “Based on a modest recovery scenario, [they] believe a global pilot shortage will emerge in certain regions no later than 2023 and most probably before. However, with a more rapid recovery and greater supply shocks, this could be felt as early as late this year. Regarding magnitude, in [their] most likely scenarios, there is a global gap of 34,000 pilots by 2025. This could be as high as 50,000 in the most extreme scenarios.” Currently, The Bureau of Labor Statistics projects a 13% increase in available jobs from 2020 to 2030 — which is, as you may have guessed, faster than the average.

What can we do to address this need?

With the need for more pilots comes the question: “How do we get more pilots?” Even though aviation can be a lucrative career choice, and aviation schools are stepping up to the plate to train more pilots, for many people the cost of a program can be too high a barrier to clear. Offering diverse payment options to prospective students — such as payment plans, student loans, or partnerships with airlines for employer reimbursement — will allow more people to enroll in flight schools and get the training required to become a pilot.

Because we recognized the distinct need for increased access to pilot training, Climb recently launched a new payment technology solution specifically for aviation programs. If you’d like to learn more about how we can help your school meet the coming demand for pilot training, reach out to our team through the form below. And below, hear from Climb team member Lily Cohen as she talks with 2MQ Consulting CEO Monica Meadows about financing options for aviation programs!